To us, this month confirms that interest rates are the main source of risk for equity markets. While stocks can’t seem to tolerate higher rates, any rate decline must also be benign… it seems as though the Fed’s “landing pad” is very narrow indeed.

July 2023 Commentary

June 2023 Commentary

Powered by “AI” optimism that has turbocharged a handful of the largest stocks in the world, markets are certainly giving the appearance of strength so far in 2023. As greed overtakes fear once again, it is worth noting that emotional markets (on the way up or down) often create allocation errors as the larger context is ignored.

May 2023 Commentary

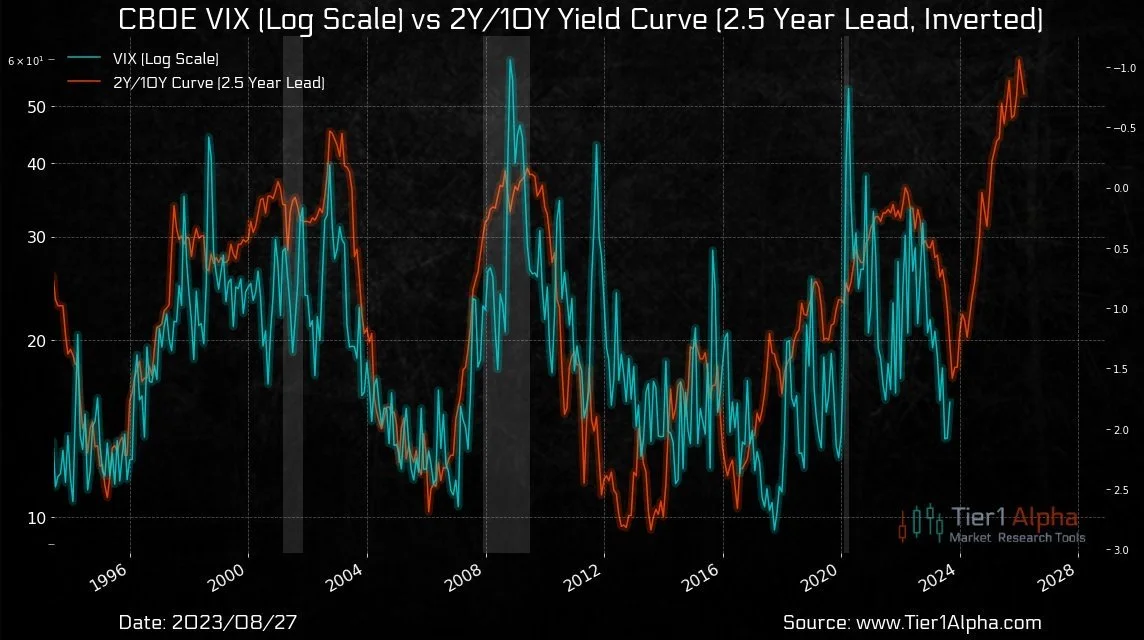

As sector rotation has so far kept a lid on index volatility in 2023, VIX headwinds from the options market have been abating as both “skew” (the price of puts relative to calls) and the price of tail protection have quietly reversed much of last year’s weakness, setting up better potential for VIX movement once conditions change