Rate expectations

S&P 500, VIX Futures and 10y Treasury Yields, Aug 2023. Source: Yahoo Finance. Click for larger image

A tight labor market, resilient US consumer and sticky inflation pushed interest rates to multi-year highs in August, pressuring equities before nerves were calmed by a less hawkish tone at the Fed’s annual Jackson Hole conference late in the month (chart).

After providing a typical equity offset for most of the month, the post-Jackson Hole relief rally saw VIX futures (VIXY: ProShs VIX Fut ETF -5.1% Aug) end lower in August in a classic “false start” pattern that commonly creates expense for TCM strategies as they prepare defensive positions for a crisis that fails to materialize. While these episodes may seem counterproductive in isolation, they are best understood as part of the process of harnessing the unique potential of VIX exposures in a true crisis that, like any insurance policy, involves an upfront cost (see next section below).

To us, this month confirms that interest rates are the main source of risk for equity markets. While stocks can’t seem to tolerate higher rates, any rate decline must also be benign- just enough to take pressure off equity risk premiums without signaling a recession. It seems as though the Fed’s “landing pad” is very narrow indeed.

wait watchers

Historically, crisis declines in the stock market are mainly created by debt market dislocations brought on by a turn in the business cycle, and broadly share three characteristics:

Panic liquidation of stocks with no distinction between sectors, fundamentals, etc.

Inverted VIX futures curve indicating strong preference for near-term protection

Elevated VIX levels (40+) indicating expectations for sustained high volatility

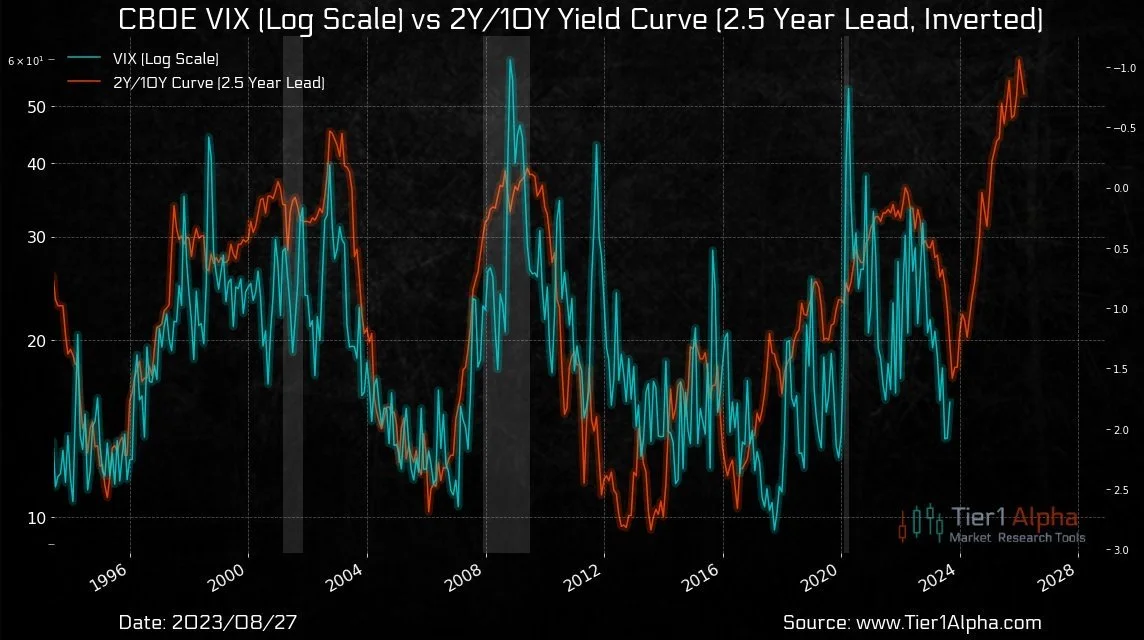

Despite the stock market’s turbulent “road to nowhere” since late 2021, it has been three and a half years since these conditions were last observed during the Corona Crisis in March 2020. While a short-sighted view might conclude that crisis declines are a thing of the past, an interpretation on the long scale of market cycles suggests otherwise. For example, based on historical relationships, the currently deep inversion in the US Treasury yield curve suggests VIX levels in the coming years well in excess of any previous crisis in VIX history, including the Corona Crisis and Great Financial Crisis of 2008.

The treasury yield curve may be pointing to a major VIX crisis move ahead.

While only one indicator and certainly no guarantee, this gives an indication of the potential magnitude of the current cycle. Successfully navigated, such an outcome would more than cover the expense of many years’ worth of “false starts” and likely produce the kind of long-term results that investors everywhere are seeking. Of course, it would not change the fact that VIX exposures had been an exercise in frustration for over 3 years, but this is how the VIX acts! Maintaining discipline during quiet periods may not always be easy, but is the most reliable way to benefit from the other side of the VIX “loop” that often springs up in an instant.

Given that market crises appear to be inevitable, producing a net benefit with VIX hedging is then just a matter of managing expenses during each waiting period. For TCM, this is accomplished with a tactical approach that a) deploys hedging “late”, only after signs of trouble and b) cuts losses on those positions every time a crisis does not materialize.

In other words, TCM portfolios actively avoid the traditional risk-management approach that seeks to address declines of any size with expensive continuous hedging that nearly guarantees underperformance over time. This novel approach was not designed to address normal, non-crisis declines, but to focus on delivering outsized potential in a truly impactful crisis that meets the criteria outlined above. Via its unique path, this process has outperformed competitors and even the market itself over time. The only relevant question is, will investors have the patience to see it all the way through?