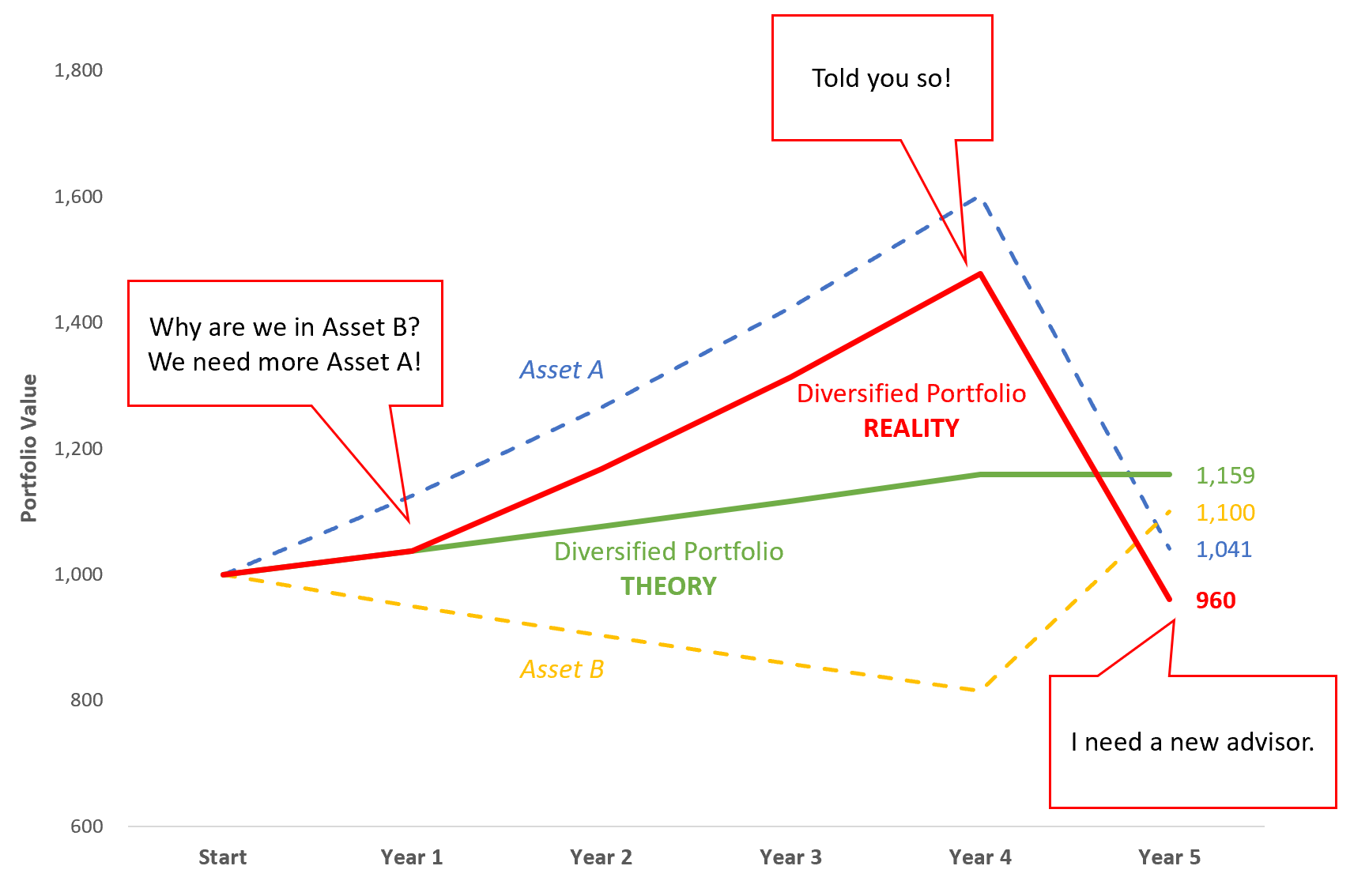

6 Month Return Comparison. Alpha Seeker returns from a sample account, net of all expenses and 1% management fee. Click for larger image

A Rudder In Stormy Seas

After racing to all time highs early in the month even as coronavirus cases spread beyond China, markets decided all at once that the threat was a threat after all, with the VIX Index spiking to the largest 1-week gain in its history as a trap door opened under the stock market. Alpha Seeker posted profits during the meltdown which were not quite enough to offset a dip in the first week of February, while Smart Index posted an outstanding relative month, finishing 5.6% ahead of the S&P 500 Index for the month thanks to profits in its long VIX exposures.

During every VIX spike, we find ourselves repeating the message that our system positions reactively based on certain changes in the VIX futures curve. Starting from near-record euphoria just a week prior, it took some time for the VIX marketplace to give the signal for long VIX exposure to be put in place. Even still, while other strategies suffered, ours largely avoided (Smart Index) or even profited during the meltdown (Alpha Seeker). Most importantly, each is now in a good spot to recover or build on the gains this year, even if this crisis marked the beginning of a bear market for equities.

With VIX, Dynamic Beats Static

The old saying among traders is that it is never possible to be happy with a position- profitable ones are always too small, losing ones always too large. This is never more true than during VIX spikes as investors review the eye-popping returns on long VIX products like iPath S&P 500 VIX Futures ETN (VXX). Conspicuously absent from this analysis is any mention of the fund’s -15% return over the past 6 months, even after returning +40% in February. For those who might take this as a green light to take the other side of the trade, the ProShares Short VIX Futures ETF (SVXY) has now returned just 0.3% over the past 6 months with 90% volatility.

While Alpha Seeker’s dynamic approach may not have been as “exciting” as VXX in February or SVXY in January, over a very challenging 6 months it has substantially outperformed these static approaches, producing an 11% annual return with just 7% volatility. For those more centered on equities, over the past 6 months Alpha Seeker has now produced roughly double the return of the S&P 500 at half of the volatility and just 0.25 daily correlation. Not just a “low vol” phenomenon, Alpha Seeker has far outpaced many of the popular “low vol” and “smart beta” indexes with a more attractive risk profile. (see chart above)

WHAT’s NEXT?

When volatility is high, short time frames carry even less information than usual and during these environments, it is often best to take a slower approach with a longer outlook. A recent tweet from the ever-insightful Chris Cole at Artemis Capital sums it up best:

Especially if it starts to affect the credit markets, the disruption from this virus certainly has the potential to become a slow-moving train wreck. As another old saying goes, we are hoping for the best and planning for the worst.