In November 2016 we started Smart Index, a novel approach to risk-managed indexing that uses tactical VIX exposure to provide downside risk mitigation with improved up-capture as compared to options-based strategies. In those 3 years, we have seen a wide range of risks including the largest 1-day VIX spike in history as well as one of the swiftest recoveries from one of the quickest bear markets ever. In short, the period since inception has provided a fertile testing ground for our approach, and we are encouraged with the results.

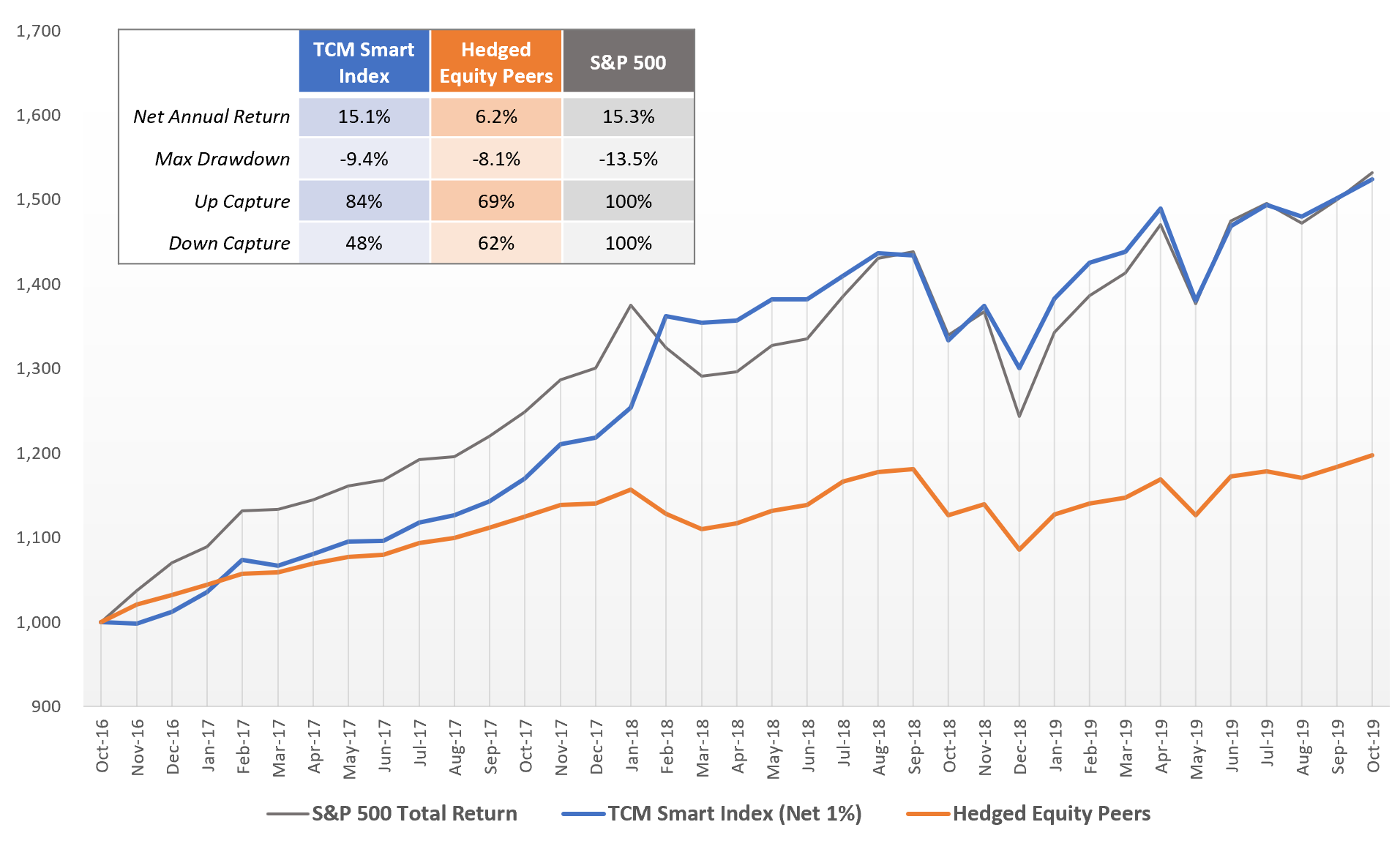

Growth of $1000, Nov 2016 - Nov 2019. “Hedged Equity Peers” is an equal-weighted composite of Swan Defined Risk (SDRIX), JP Morgan Hedged Equity (JHEQX) and Gateway Fund Cl A (GATEX), rebalanced monthly

improved up-capture with tactical hedging

The major drawback of any hedging strategy is its cost. Especially for volatile equity markets, the price demanded for protection can be significant and requires a continuous “renewal” at each expiration date. During periods when the market is rising consistently, this can result in a significant drag for continuously-hedged portfolios. Many strategies look to defray this cost by simultaneously selling protection with certain characteristics, a strategy that can introduce substantial new risks if not managed properly.

S&P 500 and TCM Volatility Dashboard signals, Nov 2016-Nov 2019

Smart Index takes a fundamentally different approach, reducing the expense of insurance by owning it only under the conditions in which protection is more likely to be needed, as indicated by our Volatility Dashboard. The result is a risk-managed portfolio that has greater potential to participate in bull markets, as demonstrated by the 84% up-capture ratio for Smart Index since inception versus 69% for its Hedged Equity Peers.

BETTER down-capture with exponential exposures

While the strike price is what determines an option’s value at expiration, there are many other factors that affect its price before expiration, including the market’s current distance from the strike price, the contract’s time to expiration and the volatility of the underlying asset. This makes the outcome of options positions a “Rubik’s Cube” of sorts, dependent on the alignment of multiple factors.

Feb 5, 2018 net returns. Click for larger image

Risk management in Smart Index is expressed differently, using VIX-linked ETFs which respond solely to changes in volatility and have greater ability to move exponentially, unanchored by strike prices or time to expiration. The most vivid example of this difference was seen on Feb 5, 2018 when the S&P 500 fell over 4%, sparking a massive change in volatility and a striking difference between the reaction of VIX products like VXX and the Rubik’s Cube pricing of options. While both approaches succeeded in reducing risk, the exponential nature of VIX was on full display that day.

A natural complement to other hedged strategies

With the bull run now entering an unprecedented second decade, allocators are increasingly turning to hedged equity strategies, with $16B across the three funds in the “Hedged Equity Peers” composite alone. Nearly all of this hedged equity universe relies on options for protection, a strategy with an admirable track record of mitigating downside and an equally-consistent history of underperformance in bull markets. Smart Index was created to fill this void by focusing on tactical hedging with exponential VIX exposures, a strategy that has improved “up-capture” without sacrificing downside protection since its inception three years ago.

Of course, investing is always about trade-offs and there is no perfect strategy. While the tactical approach in Smart Index has a proven ability to capture a greater share of bull markets, “always on” strategies are better-equipped to protect from sudden market shocks. Similarly, while VIX exposures have a greater ability to move exponentially during turbulent markets, the diversity of pricing factors can make options-based protection a more consistent exposure.

Portfolio statistics, Nov 2016-Nov 2019. “50% Smart Index / 50% Hedged Eq” portfolio is pro-forma blend, rebalanced monthly

Both approaches have merit independently, but their natural complements can also make for a powerful combination. For example, an equal allocation to Smart Index and the Hedged Equity Peers composite would have produced higher return than the Hedged Equity Peers since Nov 2016 with less volatility than Smart Index while significantly reducing risk versus an unhedged index exposure (see table).

With infinite combinations to suit any risk preference, Smart Index deserves a place in every risk-managed equity allocation. Here’s to a great 3 years and many more to come.