ROUND AND ROUND WE GO

Vol Loop progression, Sept 2019. Click for larger image

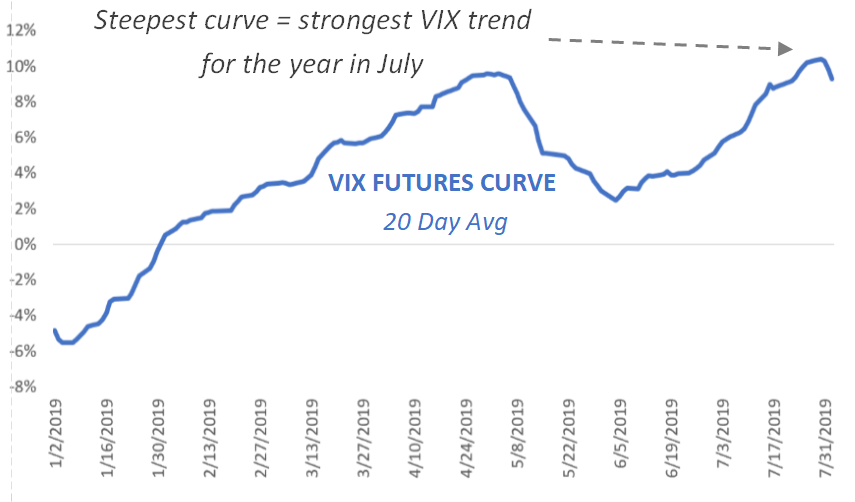

In a familiar refrain, an early burst of optimism around rate cuts and US-China trade talks fizzled throughout September as the S&P 500 faded and the VIX Index strengthened in the back half of the month. In the end, stocks were modestly higher, though still little-changed since July 4th, over the past year and since Jan 2018 highs over 20 months ago.

Despite its late rise, the VIX index remained in the “green zone” under 18 for most of the month. In this zone, VIX products are usually overpriced as they anticipate a rise in volatility that is slow to materialize (see image at left). Following the VIX “Rule of Thumb” laid out in our August commentary, TCM strategies all showed a profit in September, by either avoiding (Smart Index, Legacy Navigator) or betting against (Alpha Seeker) these overpriced contracts.

ZONE DEFENSE

At the most fundamental level, our process is like any other investment; buy cheap assets and sell expensive ones. We focus on VIX contracts because of their value proposition is uniquely quantifiable– they are tied to an index (the VIX Index) that just spins in a closed loop, from low to high and back again. Based on this concept, we created a dashboard to help us identify when VIX contracts are mispriced so we can buy them cheap and sell them dear.

Now comes the tricky part: it is not possible to own the VIX Index itself. Exposure can only be gained through VIX futures (or ETFs & options based on them). These contracts are basically guesses of where VIX will be in the future, so they are usually priced much differently than the VIX Index itself until just before expiration. Put it all together and it turns out that “value” for VIX contracts tends to be inversely correlated with the level of the VIX Index: when the VIX Index is low, VIX contracts often become overpriced and vice versa.

VIX Zones vs S&P 500 Behavior. Source: TCM. Click for larger image.

This sets up a curious situation. Since VIX inception in 1990, all of the S&P 500’s cumulative gain has come on days when VIX closed below 18 (see chart above). In other words, while the VIX is low and VIX contracts are most expensive, protection is not really needed anyway! On the other hand, the S&P has shown a cumulative loss on all days when VIX closed over 20- when VIX contracts are “cheapest” to own! In essence, VIX contracts pay investors to align with the current trend in VIX, either higher (in the “bear market zone”) or lower (in the “bull market zone”).

This is why our approach is usually to bet against VIX contracts when the VIX index is low (say, below 18) and bet with them when VIX is high (say, over 20). In between, when VIX contracts are around fair value our approach moves to the sidelines, dipping its toes in the water as VIX starts to move outside the transition zone, in either direction. What we end up with are strategies that perform best at either end of the spectrum (in bull or bear markets) and tend to churn with the market during transitions. This profile may not be a “bad day preventer”, but it is a very cost-efficient way to blunt the impact of bear markets on portfolios.

It can be frustrating while markets churn but when investing, impatience is seldom rewarded. It is precisely during these periods when advisors provide real value by maintaining discipline necessary for clients to reach their long-term goals.