“There will come a time when you believe everything is finished. That will be the beginning.”

RidERS ON The Storm

The market storm intensified in September with a -9.2% slide for the S&P 500 marking its worst monthly performance of 2022 after a hawkish Fed and an emergency bail out of English pension funds sparked disorderly moves in fixed income and currency markets. A difference of opinion unparalleled in recent history, fixed income volatility as measured by the BofA BAML MOVE index is now nearing 2020 crisis highs while the VIX index has yet to move decisively beyond 30 (chart below).

MOVE Index and VIX Index, Mar 2018 - Sep 2022. Source: zerohedge.com

Perhaps reflecting this growing tension, September’s more robust VIX response created the best relative month and quarter of the year for Tactical Beta (-6.6% Sep) and other Risk-Managed Indexing strategies, while the substitution of Alpha Seeker (+0.1% Sep) for fixed income in Legacy Navigator (-3.0% Sep) continues to widen the diversified strategy’s lead over its 60/40 benchmark on the year. In another notable development, the tech-heavy Nasdaq index (-10.6% Sep) was able to avoid seeing its worst month of 2022 in September, perhaps signaling a new broadening phase in the bear market as recession looms.

In their most defensive posture of 2022 with the VIX back at pre-crisis levels, TCM strategies are once again well-positioned for the kind of cascading market crisis where VIX exposures work best (see the “airbag” discussion below). While the market has rallied from every similar situation this year, the increasing frequency of VIX moves towards this area suggests unresolved stress that threatens to boil over with the next market “accident”.

an airbag saved my life

At a conceptual level, there are really just two versions of equity risk management. By far the most common is the “seatbelt” approach which uses exposures (typically options) that reduce a portfolio’s volatility. This method reliably restrains portfolio movement in the case of a market decline, but like a seatbelt, is useful only when used continuously. As options expire and are renewed at typically steep premiums, the cost of seatbelt-style protection also works to restrain portfolio movement in the upward direction and often makes the strategy a losing proposition as markets rise over time.

To address these drawbacks, TCM developed a revolutionary approach that uses the unique characteristics of VIX futures to manage market risk more like an airbag, deploying explosively on impact rather than restraining the driver. While it remains stowed during calm markets, “airbag” protection is costless. Even with the friction from partial deployments during minor impacts, this approach has proven to be consistently cost effective, most recently outperforming “seatbelt” giant JP Morgan Hedged Equity (ticker JHEQX) by 10.2% in the relatively uneventful year of 2021 (chart below).

Yearly Returns, 2017-2021. Source: TCM, Yahoo Finance

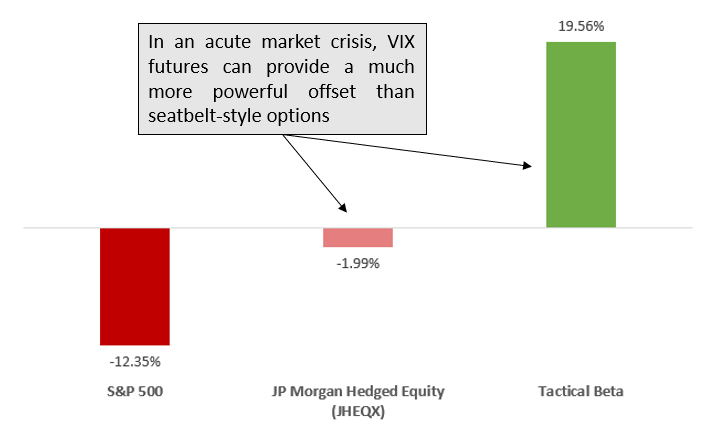

Not just cheaper, TCM’s airbag protection has also shown to be far more impactful than the seatbelt approach when it counts most, during significant market “impacts” when the pure volatility exposure of VIX futures can provide a greater offset than options contracts that are often hindered by other factors such as strike prices and time to maturity. This was most vividly displayed when the Corona Crisis of March 2020 sent the VIX index from under 20 to near 100 in a matter of weeks and VIX exposures offered many times the protection of typical “seatbelt” options as stocks cratered that month.

Monthly returns, Mar 2020. Source: TCM, Yahoo Finance

Summing up, seatbelt-style risk management offers consistent but relatively limited downside protection at substantial cost, while the airbag approach emphasizes cheaper “tail risk” defense over protection from moderate declines. While the seatbelt style often has an advantage during more measured declines like 2022, the airbag approach tends to compensate during rare but impactful crisis events such as March of 2020.

Importantly, TCM’s airbag design does not seek to reduce portfolio volatility with the VIX, but rather to add it as a potential profit source on top of stocks. This simple, revolutionary idea has produced results that set TCM apart and with the right balance, its unique tradeoffs can be weaved with other elements to form uncommonly durable portfolios.

Growth of $1000, Tactical Beta VIX positions and inverse PUT index, compounded daily Nov 2016 - Sep 2022 . Source: TCM, CBOE

By design, TCM’s “airbag” hedging approach benefits most from positive tail events in the VIX that usually coincide with an acute market crisis. Even while cracks in the market’s foundation have become obvious, the holding off of the acute phase of this crisis is also holding the door open for those still concerned about managing tail risk. The airbag has not yet fully deployed, but to remove it here is to make a hugely speculative bet and to potentially forfeit a tremendous opportunity.