low grade fever

Recalling months like October 2018 and May 2019, the VIX was largely unfazed by September’s crumble in equities with consistently upward-sloping VIX futures curves (below) signalling a lack of acute demand for protection.

Daily VIX future curves, September 2021. Source: CBOE

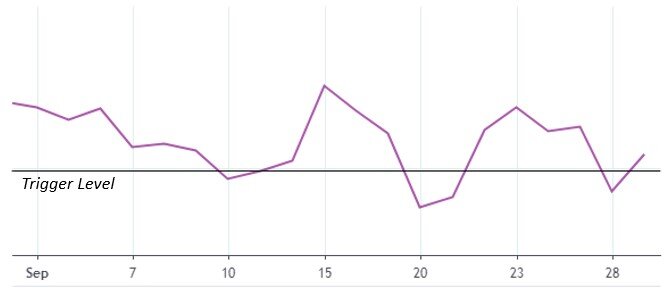

In response to this message, TCM risk-managed equity strategies made only preliminary defensive adjustments while Alpha Seeker grappled with its historically most challenging environment, the “noisy” transition range between 18 and 20 on the VIX. In this range, jumpy signals from our most-sensitive “fast” indicator (below) often result in tentative positions and hedging expense until a definitive move comes.

Volatility Dashboard “fast” indicator, Sep 2021. Source: TCM

on the horizon

As of Sept 30, the S&P 500 is less than 5% off all time highs awaiting a catalyst to either end the correction or push markets closer to a true crisis. Heading into the historically volatile 4th quarter (see below), a few possible candidates are converging in October including the expected tapering of bond purchases by the Federal Reserve and political showdowns over the US debt ceiling and the multi-trillion dollar US infrastructure bill. As always, we will take things day by day and stay attuned to the message from the VIX.

VIX Index range and average by quarter, Apr 2004 - Sep 2021. Source: CBOE