VIX yawns while stocks crumble

S&P 500 vs VIX Index, Oct 2018. Click for larger image

Defensive positioning in Kaizen portfolios is determined by signals from the VIX market as interpreted by its Vol Dashboard . Standing in sharp contrast to the experience in February this year when signs of stress appeared before and during the plunge in equities, a remarkably placid VIX in the face of October’s rout led to hesitation in the deployment of defensive (long volatility) positions and once applied, blunted their effectiveness.

Over a decade of trading volatility products we’ve seen the VIX be flat-footed on a few occasions, but its inability to trade over 30 during a 10% decline in stocks is historically unusual and suggests complacency.

A Question of Balance

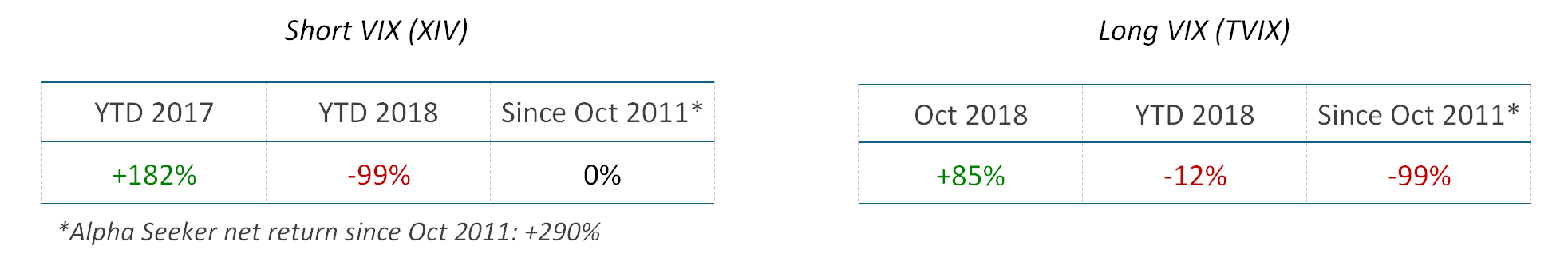

After every substantial market move, there is a natural obsession with stories of sensational gains (or losses) generated by the most aggressive approaches. They may generate website clicks, but unbalanced strategies do not succeed in creating value over time. This is especially true for VIX strategies where these approaches (short-only or long-only) have a dismal track record:

Our approach is simple: take positioning cues from the VIX and keep portfolio risk in line with the market. We’re under no illusion that this is a perfect science- and with proper risk control, it doesn’t need to be. For example, Alpha Seeker has outpaced the S&P 500 and static VIX approaches with just 45% winning days since inception and even when hindered by this month’s VIX hesitation, limited October’s peak drawdown to 1/3rd less than the S&P 500’s. With similar statistics on its VIX positions, Smart Index is ahead of the S&P 500 in a challenging year with negative down capture since its inception in 2016.

Now and Next

October’s drama has jolted the S&P 500 from its sleep and dragged it to right up to the line that divides bull and bear markets. As we saw this month, these periods present risk and just as importantly, substantial opportunity for our approach. If a new bear market is upon us, then based on history it is reasonable to expect a 30-50% decline in the S&P over the coming months accompanied by a sustained rise in the VIX well beyond its current level around 20. If instead this is just another correction in the bull market since ‘09, a return to normal volatility would see the VIX fall 40-50% from October’s close, significantly boosting the prices of inverse VIX products.

This is not to suggest that the path ahead will be easy: after all, high volatility literally means increased uncertainty and dispersion in outcomes. It might not be possible to profit from high volatility in a low volatility way, but with the proper tools we can use it to our clients’ ultimate advantage.