Equity markets were higher again in June, with recently-battered tech names roaring back relative to US small cap stocks. This resulted in a mostly sleepy VIX aside from a slight disturbance around the mid-month Fed meeting which hinted at sooner-than-expected rate hikes. Notably, treasury yields dropped on the announcement, apparently signaling a policy error that would choke growth

May 2021 Commentary

Chop chop

VIX Index May 2021

US equity markets flailed around the unchanged line for the most part in May, with the S&P 500 (+0.70% MTD) once again outpacing the tech-heavy Nasdaq 100 (-1.26% MTD) as growth and inflation expectations continue to rise. This ongoing rotation produced a jumpy, range-bound VIX and marginal signals from the dashboard, resulting in moderate hedging costs in TCM strategies and a down month for Alpha Seeker.

International markets fared better, as EAFE Smart Index (+1.92% MTD) and Emerging Markets Smart Index (+0.65% MTD) hover near 5-year highs. With its equity-based holdings and similar hedging expense to Smart Index, our new Hedged Yield strategy fell slightly (-0.60% MTD) in its first full month of trading, while currently producing a gross yield of 9.3%. Schedule a webinar with us to learn more.

on the right path

Correlation is a popular topic in finance, with investors and allocators often expressing a desire for low- or non-correlated exposures in their portfolio. However, in actually assessing these strategies the focus tends to quickly revert to total return as the yardstick for their inclusion in a portfolio. While total return is of course an important consideration, the potential benefit from a strategy’s path of return (its correlation) should not be overlooked.

The purpose of a non-correlated asset is not to add leverage, but to change a portfolio’s path of returns in a beneficial way. As an extreme example: at the right allocation, a non-correlated asset can improve a portfolio’s overall return even if the asset itself loses money! (see table below)

Hypothetical example for illustrative purposes only.

This is possible because of the different sequence of returns that results from adding the non-correlated asset. Since investment returns compound from year to year (this year’s returns are on last year’s ending value), even just changing the path of returns with a non-correlated asset can produce a benefit for a portfolio. In this case, Asset B’s preservation of capital during the market decline in year 2 produced a compounding benefit (more capital for the rally in year 3) that exceeded a small loss from the asset itself.

Of course, not all alternative assets are alike and there are the ever-present risks of allocation size, timing and psychological factors to consider. It’s not an easy task, but with the proper focus, it is possible to build more durable portfolios with an allocation to non-correlated assets.

April 2021 Commentary

steady as she goes

VIX futures prices, April 2021. Source: vixcentral.com. Click for larger image

Volatility continued to normalize as equity prices pushed higher in April, supported by strong earnings reports and ongoing accommodation from the Fed. Absent some turbulence around news of a Biden tax plan that would see capital gains rates at their highest levels in decades, a message of calm from the VIX meant positive beta exposures and positive returns for TCM portfolios throughout the month.

Benefitting from a “mini rotation” back towards growth names, Hedged Disruptor (+6.3%) and Smart Tech (+6.2%) led the way in April, while all other strategies saw continued gains including US Equity Smart Index (+5.6%) which now stands at +12.7% on the year vs +11.8% for the S&P 500, extending its lead on the index after an outstanding 2020. Not just a US phenomenon, each strategy in the Smart Index family is ahead of its benchmark on the year through April with less volatility.

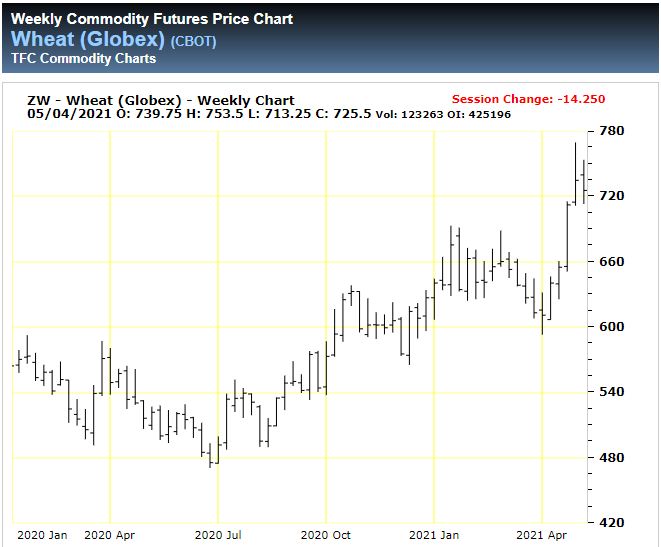

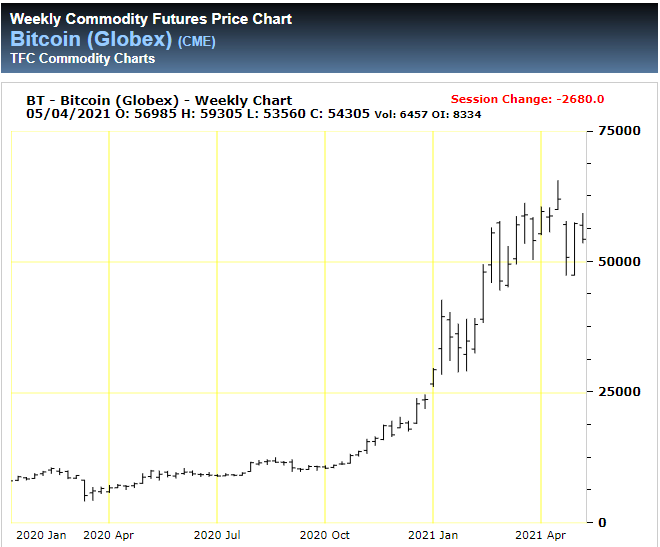

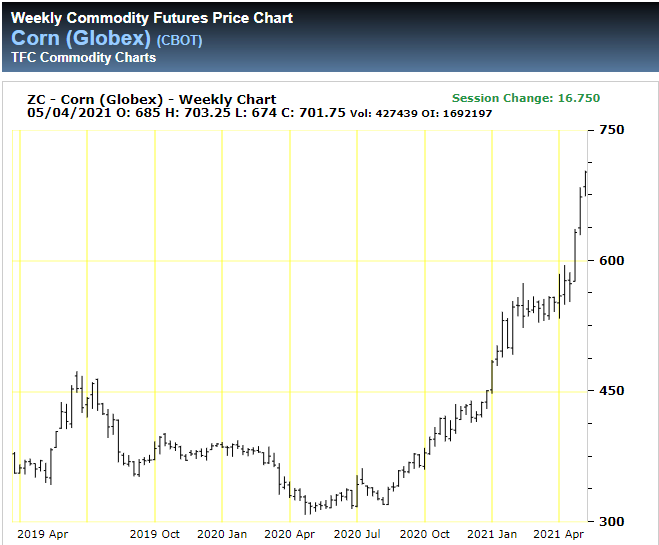

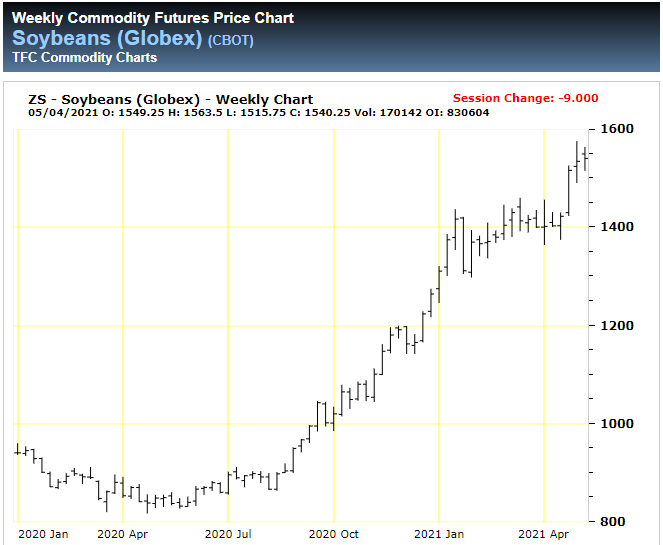

swarm of flies

As stocks continue to bask in the glow of highly accommodative monetary policy, a potential “fly in the ointment” may be on the horizon. While the Fed has repeatedly declared their willingness to temporarily let inflation run over their 2% target before raising rates, recent movements in many major commodities and alternative currencies (see gallery below) appear ready to test that statement.

As we saw earlier this year, even a mild rise in rates can cause major ripples in the equity markets of highly leveraged economies like the US. While Fed-induced episodes like in Q4 2018 can be reversed with a rate cut or two, containing an inflation-driven spike requires bold and difficult (ie, market-unfriendly) action that seems to be in short supply at today’s Fed.

This is simply an observation of one of the myriad of factors that might affect markets. Nobody (including us) knows if this will be “the” issue or even an issue at all for stocks, so we will remain focused on the message from the VIX to help guide us through whatever comes next.

March 2021 Commentary

Rotation nation

As interest rates hit a one-year high, markets continued to rotate away from large growth names in March, turning briefly violent as news of the forced liquidation of a heavily-leveraged Chinese fund made the rounds. By the end of the month most equity indexes finished higher, with smaller value exposure again benefitting at the expense of large cap growth.

Since it responds to volatility expectations in the S&P 500 as a whole, a shuffling in the component sectors is rarely the recipe for a substantial rise in the VIX index. In fact, after some early strength the VIX fell -31% in March, potentially broadcasting an “all clear” signal as it settled below the key 20 level that has been a floor since the Corona Crisis began over a year ago. Accordingly, defensive positions were largely absent from TCM portfolios in March except for a brief appearance early in the month that weighed somewhat on performance. (see next section for more on TCM risk management)

March 2021 MTD return comparison. Source: Yahoo Finance

With the lone exception of Hedged Disruptor (-9.6% YTD) which has been weighed down by the ongoing rotation from growth, 2021 is off to a strong start at TCM with Alpha Seeker (+9.5% YTD) leading the way and all Smart Indexes ahead of their benchmarks on the year. As the economy reopens and the VIX tentatively exits the “crisis formation” that has been in place for over a year, the market appears ready to move on from this crisis and begin searching for the next one.

On precision

TCM’s risk management philosophy is to lessen the effect of crisis periods by basing its equity exposure on signals from the VIX. A quantitative system might imply a certain level of precision, but ultimately the Volatility Dashboard tracks human emotion which is far from precise. The success of TCM portfolios is therefore not the result of superior accuracy, but of convexity. In other words, investor behavior is difficult to predict but when it becomes irrational, it can become very irrational.

In practice, this means that the majority of TCM’s hedging positions are expected to be unprofitable, with the less frequent profits outstripping more common losses. Indeed, as of March 2021, 58% of hedging trades in US Equity Smart Index have been unprofitable, subtracting an average of -0.75% from performance on all days when they have been present in the portfolio. On the other hand, less frequent profitable hedges have added an average of +1.51% to the portfolio on days when they have been used, including an astounding +19.1% during “Volmageddon” on 2/5/18 and +12% to +14% contributions on three separate days during the March 2020 “Corona Crisis”. This is convexity, and it can be powerful when used correctly.

US Equity Smart Index sample account daily hedge attribution, Nov 2016 - Mar 2021. Source: TCM

February 2021 Commentary

too much of a good thing

After a strong start to the month, stock markets gave back a good portion of their gains late in February, spooked by a sharp increase in rate hike expectations as hopes for economic growth continue to rise with the ongoing vaccine rollout.

With an ideal trading environment that led to profitable positions in both the early rally and late correction, Alpha Seeker (+6.3% Feb) had its best non-crisis month since 2013, continuing its strong start to the year at +8.1% YTD with just 0.12 daily correlation to the S&P 500. Taking a similar approach, Smart Index strategies (EAFE +2.8%, Emerging Markets +1.7%, Smart Tech +0.5%, US Equity +3.2%) all outperformed their benchmarks for a second consecutive month by increasing exposure during the early rally before turning more defensive during the correction.

That higher growth is taken as a negative for stock indexes is a testament to how far valuations of growth companies have been stretched by investors riding a 13-year wave of cheap money. This presents an interesting conundrum: if growth becomes too widespread, it no longer commands a premium and value can suddenly become attractive. This was clearly on display in February as growth had its worst month relative to value since 2000 (see chart below), dragging Hedged Disruptor (-2.2% Feb) to its first down month since before the election.

Investment themes will always come and go, each one a lesson on the value of flexibility over pursuit of “the answer”. Through the systematic flexibility of the Volatility Dashboard, this concept is woven into everything we do at TCM. Schedule a webinar today to see how we can help!